eBanking is experiencing intermittent issues. We are working to resolve the issue and apologize for any inconvenience.

eBanking is experiencing intermittent issues. We are working to resolve the issue and apologize for any inconvenience.

Card Controls and Alerts

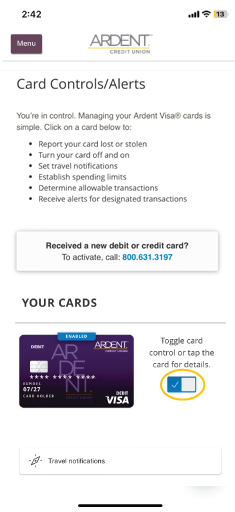

Get peace of mind knowing you’re fully in control of your Ardent Visa® debit or credit cards. Our customizable, real-time card controls and alerts are integrated within eBanking, which makes it easy to manage your cards 24/7 using your smartphone, tablet or computer. Enroll your cards for free in seconds and you’ll be able to:

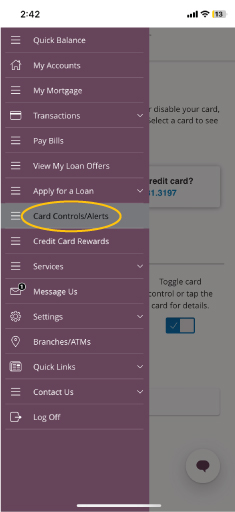

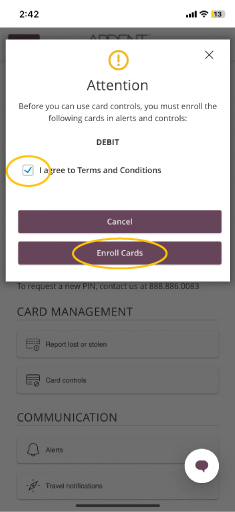

How to enroll in Card Controls/Alerts

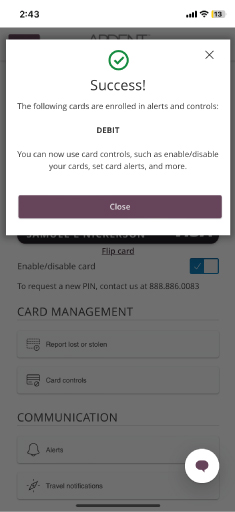

Boom. Your card is enrolled. Now, you can click on your card to manage it or report a card lost/stolen under Card Management and set text message and email alerts or travel notifications under Communication.

Tips:

Need help enrolling or using card controls? Please message us from within eBanking.

Alerts are a text message (sent from the number 66368) or email you will get letting you know when a purchase is made. You can set up alerts on all transactions or for specific amounts or merchants. After you set up an alert, you will only get a notification when a transaction is made within the selected criteria.

Controls are settings that allow your card to decline transactions that meet certain criteria. You can set up controls to decline transactions that are over certain monthly amounts, merchants, or out of the country. Keep in mind that the more controls you set up, the more declines you may see on valid transactions. If your transaction is declined because of a control you set up, you can always remove the control and try again.

No. You are now able to easily submit travel notifications within Card Controls. You can add your travel dates and locations instantly on the card(s) you plan to use.

We suggest setting the notification on your card a few days prior to travel.

Near the image of your card, click on the box that says Enable/disable card. You will be prompted to report your card as lost or stolen or to temporary disable it. Temporarily disabling your card is an effective way to block a card that you cannot locate while you look for it. To have a replacement card issued, you will need to report the card lost or stolen.

Please be aware if you get a new card, you will need to re-enroll it into card controls.

You will have visibility into all the cards linked to your accounts. However, you will not see joint owner's cards with your login. They will have to login to eBanking to enroll or manage their cards.

If you do not see a card that you were expecting to see, please message us.

If the expiration date is different in Card Controls than the card you have in hand, you have not activated a new card that was sent to you. You should always use the most recent card issued to you, even if the card in hand is still valid.

Note: In the summer and fall of 2023, Ardent re-issued cards with the new tap-to-pay feature. Please activate the most recent card you received. If you did not receive your reissued card, please message us in eBanking.