eBanking is experiencing intermittent issues. We are working to resolve the issue and apologize for any inconvenience.

eBanking is experiencing intermittent issues. We are working to resolve the issue and apologize for any inconvenience.

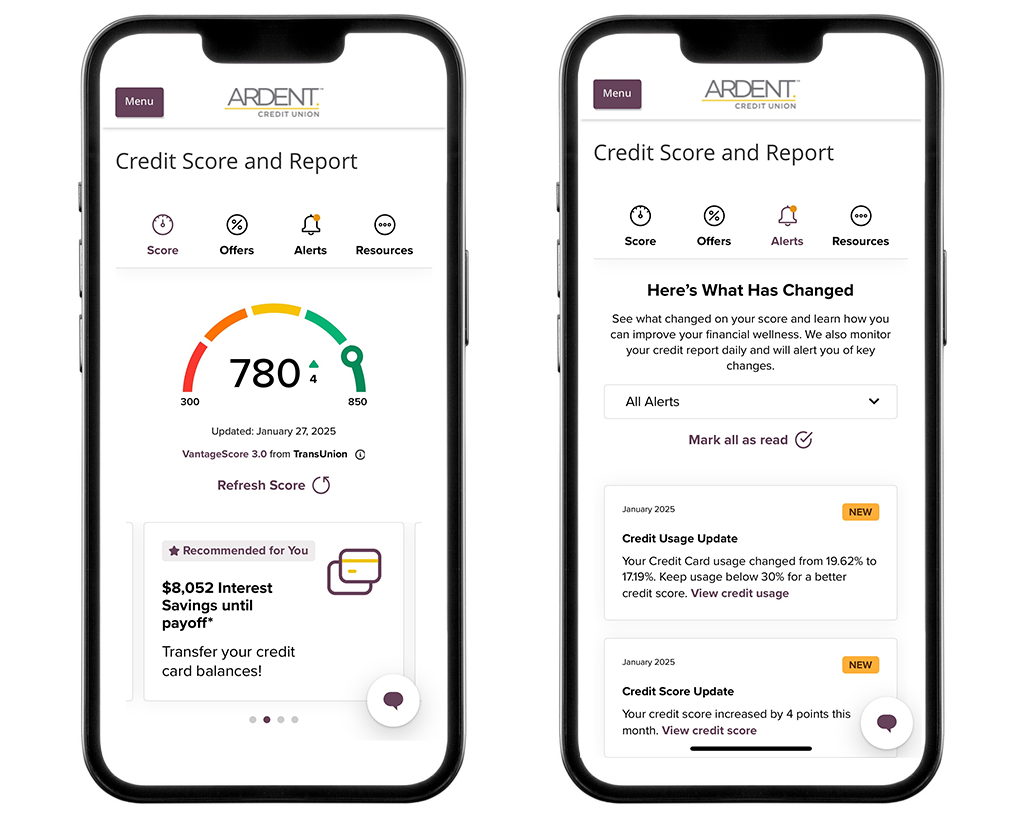

CreditSavvy

Your credit score, alerts and more. 24/7

CreditSavvy is a powerful, free tool in eBanking that allows you to securely monitor your credit, set goals to improve your credit score, access resources to grow your knowledge and more—anytime, anywhere.

Become CreditSavvy today by logging into eBanking and selecting CreditSavvy from the main menu. No need to register, but you may be asked to provide some information to confirm your identity.

CreditSavvy features:

Not using eBanking yet? Get started here.

CreditSavvy, powered by SavvyMoney®, is a free tool in eBanking that allows you to securely check your credit score daily, set up credit alerts, review your credit report, receive credit offers and access tips to boost your credit health.

All eBanking users are automatically able to access CreditSavvy from the main eBanking menu. There is no need to enroll.

CreditSavvy pulls users’ credit profiles from TransUnion, one of the three major credit reporting bureaus. It uses VantageScore 3.0, a credit scoring model developed collaboratively by the three major credit bureaus: Equifax, Experian and TransUnion.

CreditSavvy uses VantageScore 3.0 from TransUnion. It may differ slightly from scores used by other credit bureaus, including your FICO® score. Each credit bureau has its process for correcting inaccurate information, but you can file a dispute by clicking on the "Start a Dispute" link at the bottom of your credit report within CreditSavvy.

No, Ardent uses its own lending criteria when making lending decisions and has no access to your CreditSavvy score.

If you regularly access eBanking, your credit score will be updated every 7 days. You can also refresh your credit score and full report every 24 hours by clicking “Refresh Score” and navigating to the detailed Credit Score Dashboard within eBanking.